Imposter Assassin 3D

Play the entertaining 3D action game Imposter Assassin 3D to transform into a true assassin. It has stealth, shooting, action, enemy guards, and a ton of levels and skins to unlock. Assume charge of an imposter who dares to enter the control base. Numerous enemy troops will be patrolling each level, and they will kill you right away if they discover you.

Play Now

Realistic Lion Hunting Animal 2024

Experience the thrill of the wild in Realistic Lion Hunting Animal 2024! This immersive simulator puts you in the paws of a majestic lion, roaming a vast and realistic forest. Hunt various animals to survive and advance through challenging levels. Explore the dense wilderness, track your prey, and feel the rush of the hunt. Perfect for those seeking adventure and excitement in the animal kingdom. Can you survive the wild?

Play Now

Escape Room - Home Escape

Escape Room - Home Escape HTML5 game: Try to Escape in this Escape game. Find all clues and solve all puzzles.

Play Now

Soldier Attack 1

Soldier Attack 1 HTML5 game: Shoot the aliens in as less shots as possible. Click to shoot

Play Now

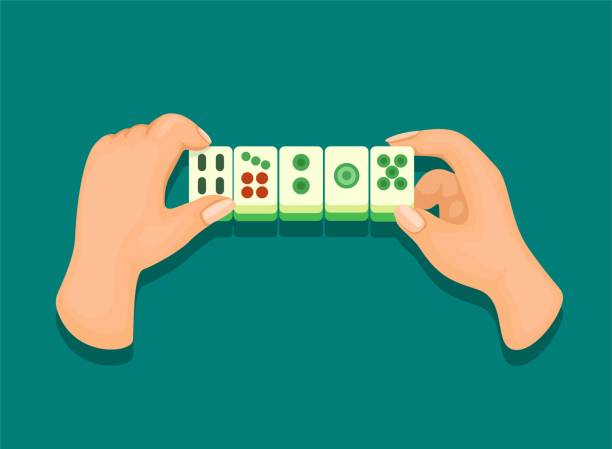

Dark Mahjong Connect

Dark Mahjong Connect HTML5 game: Mahjong Connect with a Dark theme. Connect 2 of the same tiles and remove all tiles.

Play Now